A European Union Directive from 2009 set terms and conditions to allow certain highly qualified and skilled citizens of non-EU countries to more easily obtain residence/work permits in certain EU member countries. In August 2012 the German government finalized legislation that put this directive into practice.

The primary feature of the new law is the introduction of a new type of residence permit commonly referred to as the EU Blue Card. The legislation is designed to make emigration to Germany more appealing to qualified foreign citizens in order to fill the ever-growing number of jobs that require highly skilled workers.

The law also eases various restrictions on foreign students who want to stay and work in Germany after completing their university studies.

Important information on the new legislation has been posted on the website of the German Federal Office for Migration and Refugees at this link. There is also a very informative FAQ page on the same website at this link. Information can also be found on other non-official websites. According to those sites, some of the main points are:

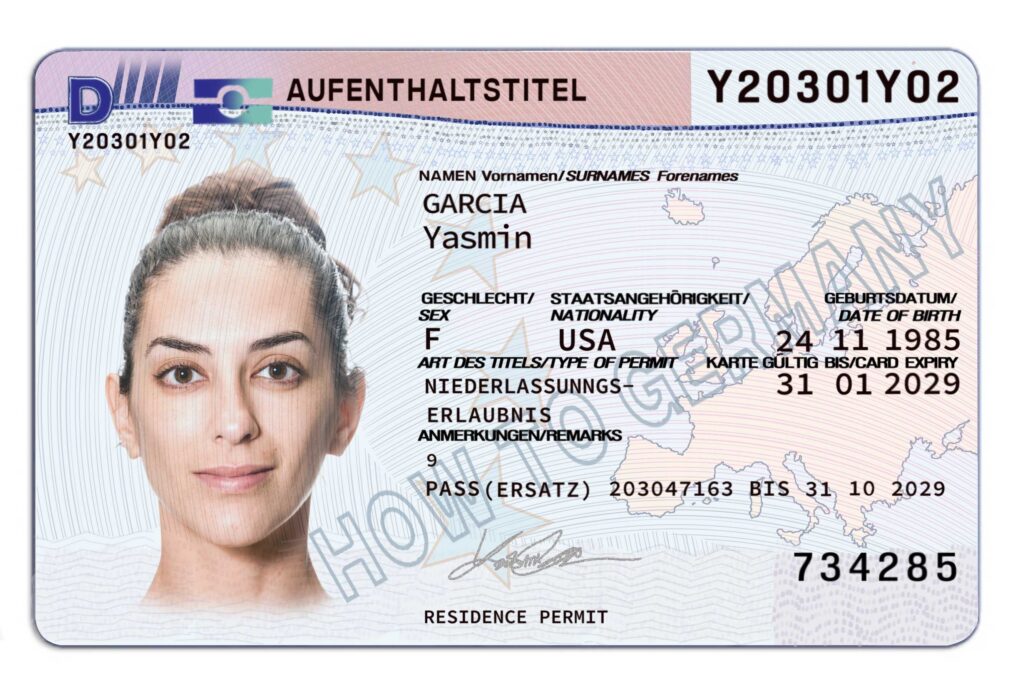

EU Blue Card. Credit: How To Germany

EU Blue Card for Germany

- To qualify for the Blue Card an applicant must have a university or college degree and an employment contract with a German company that pays a salary of at least €56,800 per year (2021).

- For certain occupations that suffer from shortages of skilled labor the salary level is €44,304 per year (2021). This pertains to engineers, qualified communications and technology experts, medical doctors and certain other fields.

- To hasten the process for qualified applicants there will be no “priority reviews”. This means that the time-consuming procedure of checking whether there are qualified Germans or non-German current residents that may be first in line for certain positions may be waived.

- The Blue Card may initially be valid for up to four years. (If a work contract is shorter than four years the validity period may be shorter than four years.) An application for unlimited residence permit (Aufenthaltstitel) may be applied for after three years. If a Blue Card holder has sufficient knowledge of the German language (Level B1) he or she may apply for the unlimited residence permit after 2 years.

- Family members of a Blue Card holder are allowed an unrestricted right to work in Germany. Spouses do not have to speak German to join the Blue Card holder in the country.

- Moving from one EU country to another or leaving the country for an extended period of time is possible, but there may be restrictions depending on each country’s laws and interpretation of the EU directive. (For example, Blue Card holders that get their Blue Card from Germany must stay in Germany for eighteen months before moving to another country.)

As mentioned, these are the most important parts of the new legislation. There are other provisions. Anyone interested in more information about the Blue Card should contact the local authorities if they are currently in Germany. If living outside of Germany a person may make an application for a Blue Card at the nearest German Embassy or Consulate in their country of residence.

More information

You can download an English Language brochure from the Federal Office for Migration and Refugees that explains in detail the legal requirements of residence for third-country nationals who would like to (and currently may be) studying and working in Germany here.

Click here to read our article on obtaining a standard Residence Permit in Germany.

Different Circumstances for some Foreign Residents of Germany

The overwhelming majority of legal foreign residents in Germany are in the country with one of the standard residence permits issued by the German authorities allowing them (and their eligible family members) to live in Germany while working for a German company or studying at a German school. Residency is also normally granted in most cases to eligible EU citizens and spouses of German nationals.

There are, however, a number of foreigners that are in Germany legally under other circumstances. Uniformed military (and their accompanying family members) from the USA and NATO countries are allowed residency under various Status of Forces Agreements (SoFA) negotiated with the German government. Civilians that work for the various defense departments or ministries as well as diplomats and other foreigners assigned to their country’s embassy or consulates may also have a different status (as do their family members). A different status may also be afforded to foreigners who work in Germany for companies that contract with the various foreign military and diplomatic offices of other countries. Some residents that are self-employed may also fall under this category.

Issues regarding residence permits, health insurance, tax status and filing requirements, spousal employment, eligibility for German social benefits, German driver’s licenses, proper registration procedures and others things may raise questions from this group.

For example, if a spouse of an active duty USA military member takes a job with a German company would he or she be eligible for German benefits? What sort of tax issues would that present? Or suppose a person from the USA, UK or Canada is working for a home country based company that has a contract to perform services in Germany? Would health insurance issues and benefits be involved?

These are just a couple of examples of the sort of situations that those in Germany under “different circumstances” may face.

There are specialized companies that have in-depth knowledge of these complicated issues and can guide people through the bureaucratic maze to make sure that they are in full compliance with German regulations and are able to take advantage of the various benefits that may be available to them.

If you think you may fall under any of the “different circumstances” you may want to get in touch with experts regarding legal, accounting and tax matters who can offer advice and help.

(RFP Steuerberatung, an advertiser on this site, is one of the companies that may be able to help.)